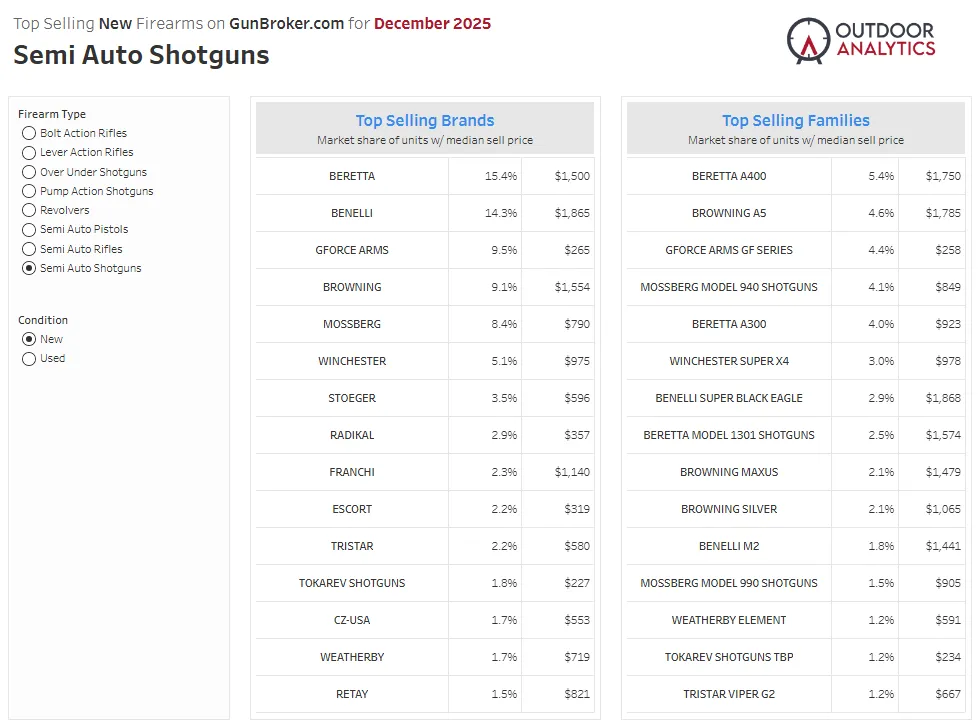

Top Selling Semi Auto Shotguns on GunBroker (December 2025): Brands, Models, and Median Prices

If you’re shopping for a semi-auto shotgun (or stocking them, or planning your next season), it helps to know what’s actually moving in the market—and roughly what buyers are paying. This December 2025 snapshot of top selling semi auto shotguns on GunBroker.com breaks sales into two practical views: which brands led by unit share, and which model families captured the most demand, along with each one’s median sell price.

In plain English: this is a quick read on “what’s popular” and “what it tends to sell for,” based on new-condition listings that sold during the month.

Quick Take

- Beretta (15.4%) and Benelli (14.3%) lead brand share for new semi-auto shotguns sold in December 2025—both with premium median sell prices.

- The single top model family by unit share is the Beretta A400 (5.4%), closely followed by the Browning A5 (4.6%).

- There’s a clear “two-lane” market: premium families (A400, A5, SBE, 1301) and value families (notably GForce Arms GF Series) with a much lower median price.

- Mossberg’s 940 (4.1%) shows strong unit demand at a midrange median price—worth watching if you’re trying to balance cost and brand familiarity.

- What to watch next: whether value-priced brands keep gaining share, or if premium families dominate seasonal buying windows.

What the image shows

This visual is titled “Top Selling New Firearms on GunBroker.com for December 2025” with the category set to Semi Auto Shotguns and Condition: New. It presents two ranked lists:

- Top Selling Brands — each brand’s market share of units (how many of the sold items in this category were that brand) and the median sell price for that brand’s sold listings.

- Top Selling Families — specific model families (example: “Beretta A400”) with the same two metrics: unit share and median sell price.

Snippet-ready definition: “Market share of units” means the percent of sold items in this category that belong to a given brand or family. “Median sell price” is the midpoint sale price—half sold for more, half sold for less.

Not shown: exact unit counts, geography, gauge breakdown (12 vs 20, etc.), barrel length, and whether sales are auctions vs buy-now. The chart is a category snapshot, not a full spec-by-spec breakdown.

The biggest takeaways

- Brand leadership is tight at the top. Beretta (15.4%) and Benelli (14.3%) are separated by only about a point of unit share.

- Premium pricing is concentrated in the leaders. The top two brands also show high median sell prices ($1,500 and $1,865), suggesting strong demand where buyers accept higher price tags.

- Browning and Mossberg are meaningful share players. Browning (9.1%) and Mossberg (8.4%) combine strong unit share with median prices that sit below the very top-tier names (but still not “budget”).

- Value brands can move real volume. GForce Arms holds 9.5% brand share with a very low median sell price ($265), which suggests a lane for entry-level or budget-driven buyers.

- At the model-family level, the A400 leads. The Beretta A400 (5.4%) is the top family in this view, with a premium median price ($1,750).

- Midrange “workhorse” families stand out. Mossberg Model 940 (4.1%, $849) and Winchester Super X4 (3.0%, $978) show broad appeal around the sub-$1,000 level.

- Several premium families remain highly competitive. Browning A5, Benelli Super Black Eagle, and Beretta 1301 all hold meaningful share at higher median prices.

- The chart suggests a split market. If you’re shopping, you’re likely choosing between “premium performance/features” vs “budget-friendly availability,” with fewer options in the true middle.

Concise summary paragraph (snippet-ready): December 2025 GunBroker sales for new semi-auto shotguns show Beretta and Benelli leading brand share, with the Beretta A400 as the top model family. Median prices cluster in two groups—premium families around $1,400–$1,800 and value options far lower—suggesting buyers are either investing in flagship models or prioritizing affordability.

Data table from the image

Below is a text version of every brand and model-family row visible in the image, including unit share and median sell price. Use this to compare “popularity” (share) against “typical closing price” (median).

| Top Selling Brands — New Semi Auto Shotguns (GunBroker.com, December 2025) | ||

|---|---|---|

| Brand | Market share of units | Median sell price |

| Beretta | 15.4% | $1,500 |

| Benelli | 14.3% | $1,865 |

| GForce Arms | 9.5% | $265 |

| Browning | 9.1% | $1,554 |

| Mossberg | 8.4% | $790 |

| Winchester | 5.1% | $975 |

| Stoeger | 3.5% | $596 |

| Radikal | 2.9% | $357 |

| Franchi | 2.3% | $1,140 |

| Escort | 2.2% | $319 |

| Tristar | 2.2% | $580 |

| Tokarev Shotguns | 1.8% | $227 |

| CZ-USA | 1.7% | $553 |

| Weatherby | 1.7% | $719 |

| Retay | 1.5% | $821 |

| Top Selling Families — New Semi Auto Shotguns (GunBroker.com, December 2025) | ||

|---|---|---|

| Family (Model line) | Market share of units | Median sell price |

| Beretta A400 | 5.4% | $1,750 |

| Browning A5 | 4.6% | $1,785 |

| GForce Arms GF Series | 4.4% | $258 |

| Mossberg Model 940 Shotguns | 4.1% | $849 |

| Beretta A300 | 4.0% | $923 |

| Winchester Super X4 | 3.0% | $978 |

| Benelli Super Black Eagle | 2.9% | $1,868 |

| Beretta Model 1301 Shotguns | 2.5% | $1,574 |

| Browning Maxus | 2.1% | $1,479 |

| Browning Silver | 2.1% | $1,065 |

| Benelli M2 | 1.8% | $1,441 |

| Mossberg Model 990 Shotguns | 1.5% | $905 |

| Weatherby Element | 1.2% | $591 |

| Tokarev Shotguns TBP | 1.2% | $234 |

| Tristar Viper G2 | 1.2% | $667 |

How to read this table: Start with the “market share of units” column to see what sold most often in this category during the month. Then use “median sell price” to sanity-check your budget: it’s a practical “typical closing price” for that brand or family. A high share with a low median usually points to budget demand; a high share with a high median suggests buyers are actively choosing premium models.

What this means for you

If you’re a new buyer

The chart suggests two common starting points: proven midrange families around the sub-$1,000 mark (like the Mossberg 940, Beretta A300, and Winchester Super X4) and budget options where price is the main driver (example: GForce Arms GF Series). If you’re learning fundamentals, prioritize fit, reliability, and ammo availability over chasing a trend—then compare listings to the table’s median prices so you know what’s “normal” versus overpriced.

If you shoot clays or compete

Premium families lead the top of the list (A400, A5, SBE, 1301), which aligns with what many high-volume shooters want: smoother cycling, better recoil management, and long-term durability. The practical move is to use the median sell price as your starting bid/offer reference, then adjust for the specifics not shown here (barrel length, rib, choke set, condition notes, included accessories).

If you’re a hunter planning for next season

Demand in December often reflects holiday buying and pre-season planning for some hunters. The data suggests strong interest in versatile semi-autos across price points. If you’re buying for the field, make a shortlist by intended game and environment (waterfowl vs upland vs turkey), then use this table to check whether your target model family is routinely clearing at a price that matches your budget.

If you’re a retailer, brand, or range operator

This split-market pattern (premium leaders + value-volume movers) is a merchandising hint. Consider a “good / better / best” lineup anchored by a midrange workhorse family (sub-$1,000 medians), supported by at least one premium flagship, and a budget-friendly option for first-time buyers. Where possible, pair sales with training, fitment support, and accessories (cases, chokes, cleaning gear) to improve customer outcomes and reduce returns.

Safety + responsibility reminder: Always follow local laws, manufacturer instructions, and range rules—and get hands-on fit and handling guidance from qualified, legal sources before purchasing or using any firearm.

Smart next steps

- Set your “median-based budget” first: pick a brand/family, start with the median sell price from the table, then reserve extra for taxes/fees, transfer costs, and essentials.

- Choose your lane: decide whether you’re optimizing for premium features (higher median) or affordability (lower median), then shop within that lane to avoid endless comparison.

- Compare apples-to-apples: for any listing, check what’s not shown in this chart (gauge, barrel length, included chokes, accessories, and any package deals).

- Watch for “family name” confusion: listings can bundle variants under one family label—verify the exact model variant before you buy.

- Track a short list for 2–3 weeks: if you see consistent closing prices near the median, you’ll know when a listing is truly a deal.

Common questions

What does “top selling” mean in this chart?

It refers to the share of sold units within the chart’s filter: new condition, semi auto shotguns, on GunBroker.com, during December 2025.

Is the median sell price the same as MSRP?

No. The median sell price is based on observed sale outcomes in this category and timeframe, not manufacturer list price.

Why can a brand have high share but a low median price?

That usually suggests many sales are happening at entry-level price points—often driven by budget-conscious buyers, availability, or a surge of listings in that tier.

Which model families lead this month?

In this image, the top family is Beretta A400 (5.4%), followed by Browning A5 (4.6%), then GForce Arms GF Series (4.4%) and Mossberg Model 940 (4.1%).

Can I use this to time my purchase?

Use it as a baseline, not a guarantee. This is a single-month snapshot. For timing, track your shortlist across multiple weeks or months and compare to these medians.

What’s missing that could change the price a lot?

Gauge, barrel length, furniture/finish, included chokes and accessories, and exact variant details can all move pricing—none of those specs are shown in this chart.

Conclusion

This December 2025 view of top selling semi auto shotguns on GunBroker shows a market with clear leaders: Beretta and Benelli at the brand level, and the Beretta A400 at the family level—plus strong midrange momentum from Mossberg and Winchester families. Use the table above as a reality check for “what’s popular” and “what it tends to cost,” then narrow your choice based on your use case and the exact specs that matter to you.